VAT CheckMachine app for iPhone and iPad

The Ultimate VAT check machine!

Comprehensive • Powerful • Flexible • Beautiful • Free!

• Replaces 2 or more apps, keeps your iPhone tidy

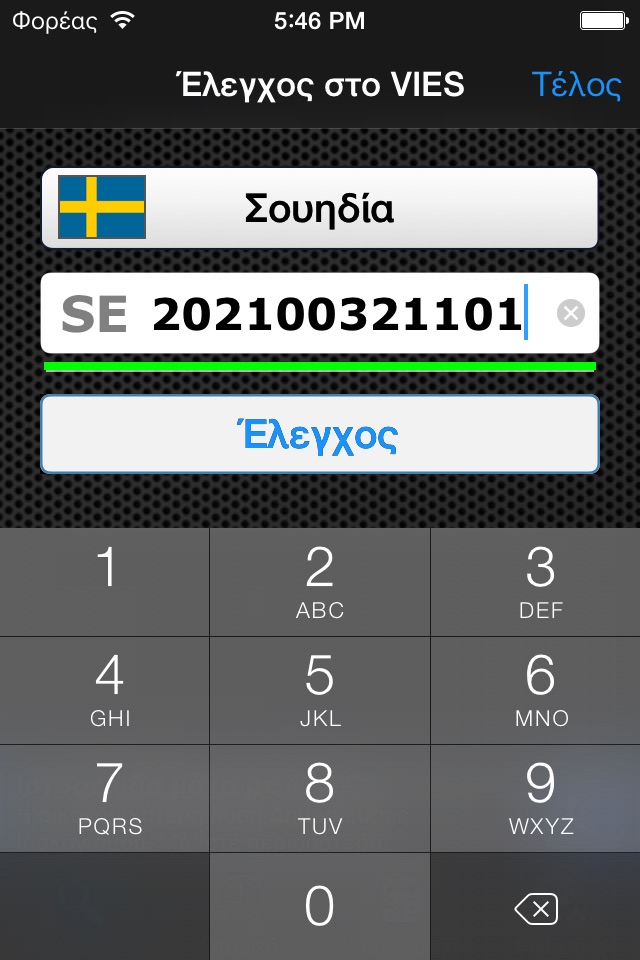

• On-the-fly correctness test of VAT numbers of all 28 EU states

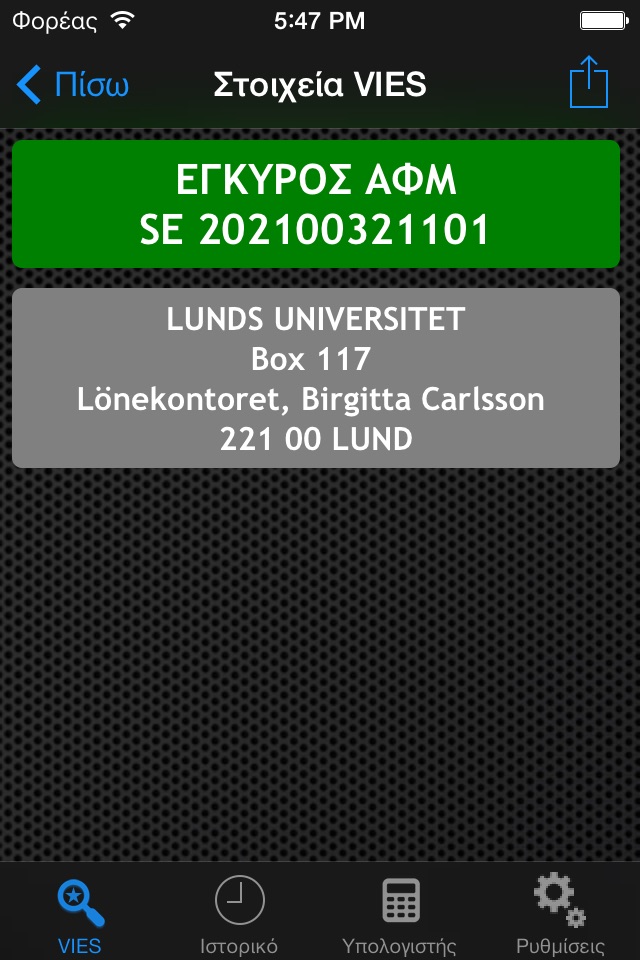

• Checks European VAT numbers (28 states) with EU authorities (VIES)

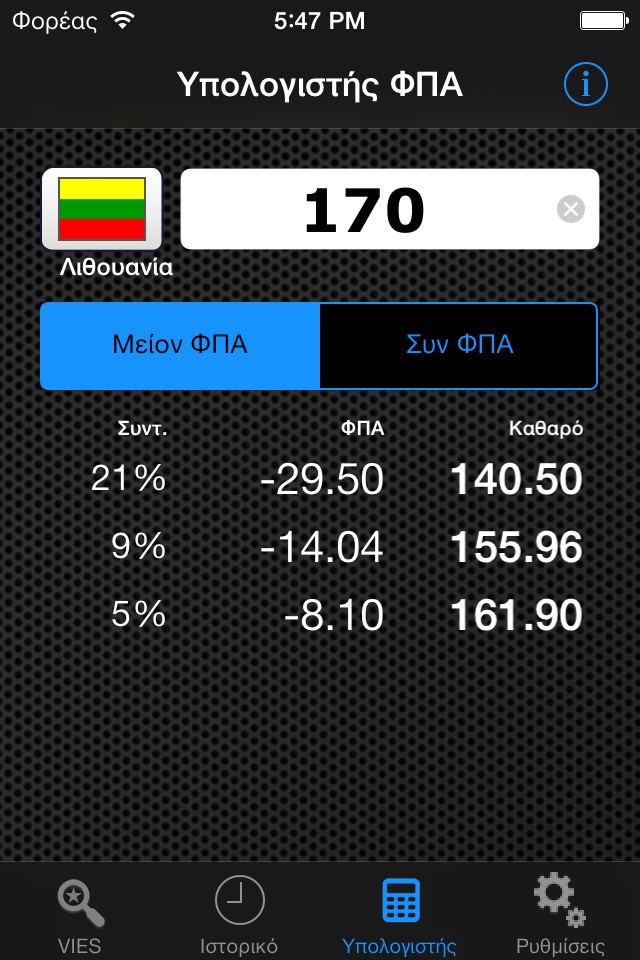

• Calculates VAT and Net/Gross amounts for all rates of all 28 EU states

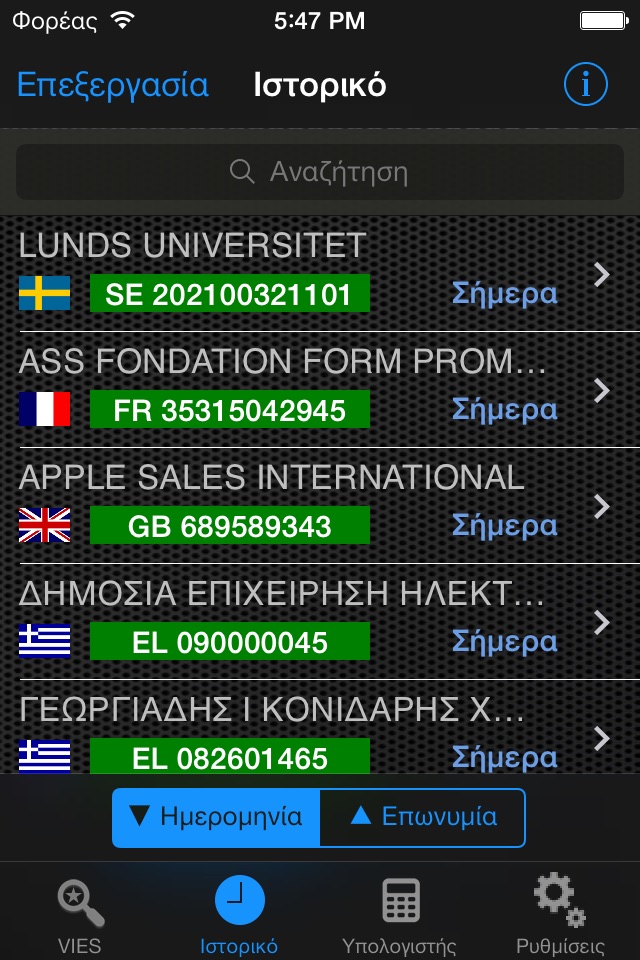

• Keeps checked numbers history for reference and sharing

What is it?

CheckMachine is a free (ad-supported) iPhone app that encompasses a wealth of VAT-related functions within a single app:

Instantly* validates all EU VAT numbers, so that you can safely issue zero-VAT invoices to entities entitled to VAT exoneration according to EU laws.

Instantly calculates VAT and Net/Gross amounts for any amount you type, as you type it, and it does this for all VAT rates of all 28 EU states!

Checked numbers can be added to History either automatically or manually, for reference and sharing with other apps or people. Auto-add is enabled through the apps Settings page.

* Depending on availability of the VIES web service.

Whom is it for?

This app is a valuable free resource for business and pleasure. It serves those in the European Union involved with invoicing intra-EU transactions, and those in need of a handy and speedy VAT calculator that works in all EU states.

How does it work?

As the user types a VAT number of any EU state, the app examines its correctness ("well-formedness") on-the-fly using the actual algorithms of each EU state, not just the number and type of digits! This step ensures usability and keeps traffic and fees low.

EU VAT numbers (from any of the 28 EU states) are checked using the official web service maintained by the European Commissions VAT Information Exchange System (VIES).

Attention: Not all correct VAT numbers are valid, therefore you must always check the validity of all VAT numbers before actually using them in invoices.